Briefing note

The value of regional goods exports will rise 9.7% in 2018, registering a second straight year of growth after the notable decline seen between 2012 and 2016, according to the latest projections from the Economic Commission for Latin America and the Caribbean (ECLAC), released today in Mexico City.

This increase can be broken down into a 7.6% increase in prices and a 2.1% rise in volume, ECLAC indicates in its annual report International Trade Outlook for Latin America and the Caribbean 2018, presented at a press conference by the United Nations regional organization’s Executive Secretary, Alicia Bárcena.

Despite the increase, the region’s export volume is seen growing by less than half the pace of shipments from developing economies as a whole which, according to World Trade Organization (WTO) projections, are seen expanding 4.6%, ECLAC warns in the publication, which analyzes the impact of divergent global growth and trade tensions on the region’s trade.

The region’s goods imports will also rebound in 2018 for a second straight year: their value is seen rising 9.5% but, in contrast to what is happening with exports, they will grow more in volume (4.9%) than in price (4.6%).

The evolution of the region’s foreign trade in 2018, in addition to being a reflection of each country’s level of economic activity, will be determined by the structure of export and import baskets, as well as by the external demand of its main trading partners. In South America, for example, the growth forecast for exports (10.2% in value) fully responds to an increase in commodities prices, especially for oil and minerals and metals. A similar trend is seen in the Caribbean, where the expected sharp rise (12.1%) is strongly influenced by higher prices for the oil and gas exported by Trinidad and Tobago.

In the case of Mexico, the increase in volume and the rise in prices will contribute in similar proportions to the expansion of exports (a total of 9.5% in value). Lastly, in Central America, projected growth in shipments abroad (3.6%) can be fully explained by an increase in the volume exported, since the prices of the export basket will fall slightly (-0.8%), due to declines in products such as sugar and coffee. Manufactured shipments from Mexico and Central America are being favored by vigorous demand in the United States.

With regard to the main trading partners of Latin America and the Caribbean, shipments to China – made up almost entirely of raw materials and natural resources-based manufactured goods – are seen notching the highest increase (28%) in 2018. This situation reinforces the region’s specialization in commodities exports, particularly in South America. In contrast, exports within the region and to the United States, which tend to have greater manufactured content, are seen growing at significantly lower rates (12% and 7.1%, respectively).

With regard to imports, it is also those coming from China – which is the second country of origin for the region’s imports, after the United States – that show the most dynamism. These are composed nearly entirely of manufactured goods that compete with regional production in various sectors.

The report International Trade Outlook 2018 explains that the backdrop to current trade tensions between the United States and China is the dispute for global economic and technological leadership, as well as the debate over the coexistence of different development patterns. According to ECLAC, in the short term these tensions could have a positive impact on regional exports, but a scaling-up of protectionism would entail serious risks for the global economy and, therefore, for the region as well.

“Regional integration is indispensable for making progress on the diversification of exports and on the transition toward a more knowledge-intensive export basket, considering the elevated industrial content of intraregional trade and its importance for SMEs that export,” Alicia Bárcena, ECLAC’s Executive Secretary, underscored. “It is necessary to intensify efforts aimed at building an integrated regional market given the context of slowed growth, net capital outflows and growing protectionism that the region faces, and which will likely worsen in 2019.”

In the report’s second chapter, ECLAC indicates that the region as a whole is a net exporter of minerals and metals, with 8% participation in global exports in this sector. However, its shipments are characterized by a low degree of processing. The participation of raw materials in the region’s exports of minerals and metals (currently 37%) has nearly doubled in the last 20 years due largely to demand from China and the rest of Asia. This situation is worrisome, the Commission says, because of the known problems associated with dependence on the export of raw mineral products, such as the vulnerability of exports, economic growth and tax income to price fluctuations; little value added or diversification toward new products and services; and diverse types of environmental harm.

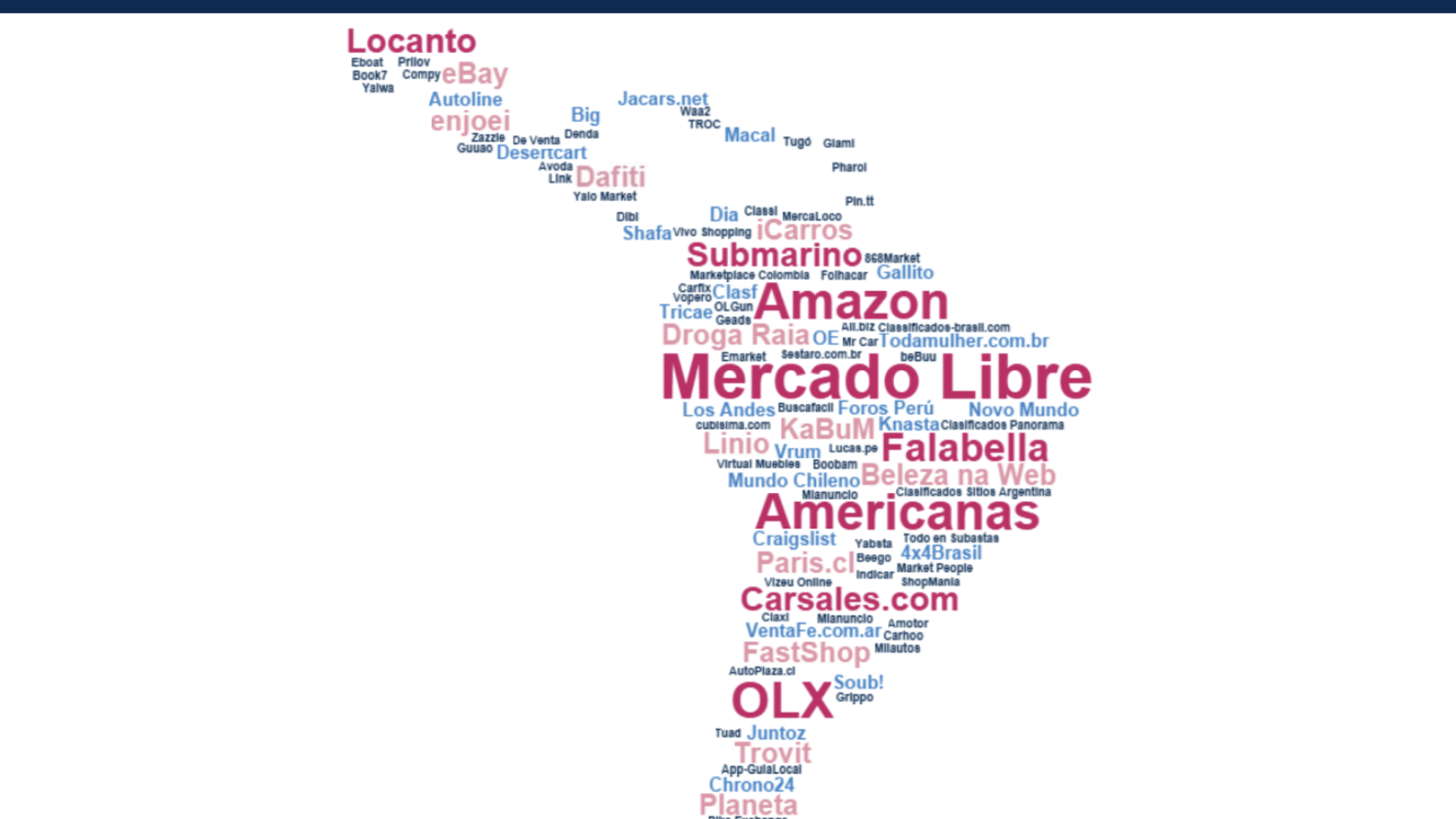

Finally, the third chapter analyzes the potential of cross-border e-commerce for invigorating and diversifying regional exports. The region has rapidly increased its consumption of imported products through foreign-owned electronic platforms, but it has not increased its exports through this means to the same extent. The participation of Latin America and the Caribbean in global cross-border electronic commerce is seen rising from 2.6% in 2014 to 5.3% in 2020, according to the report.

To promote electronic commerce in the region, ECLAC proposes forging the regional digital market; promoting digitalization and simplified financing for trade; modernizing customs offices and postal services; and reducing the costs of online cross-border payments.